Outsourcing would maintain the same amount of sales but decrease the investment in equipment at the same time.Ī low turnover indicates that the company isn’t using its assets to their fullest extent. High Turnover Ratio-What Do They Mean?Ī high turnover indicates that assets are being utilized efficiently and large amount of sales are generated using a small amount of assets.Īdditionally, it could mean that the company has sold off its equipment and started to outsource its operations. Since using the gross equipment values would be misleading, it’s recommended to use the net asset value that’s reported on the balance sheet by subtracting the accumulated depreciation from the gross.īusinesses often purchase and sell equipment throughout the year, so it’s common for investors and credit lenders to use an average net asset figure for the denominator by adding the beginning balance to the ending balance and dividing by two.

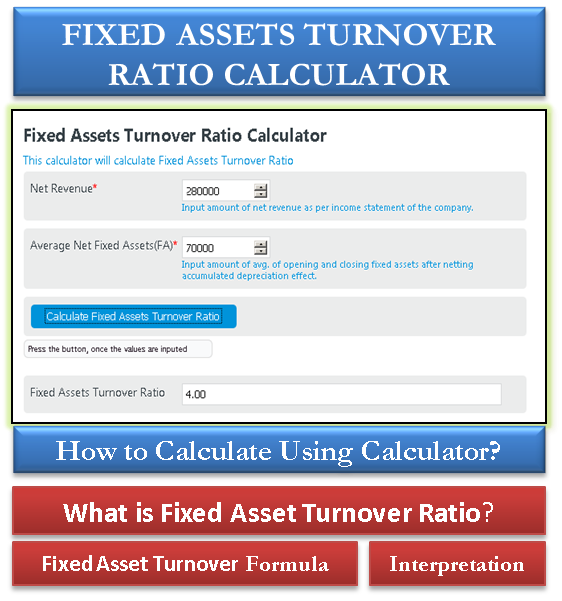

The fixed asset turnover ratio formula is calculated by dividing net sales by the total property, plant, and equipment net of accumulated depreciation. PPE turnover ratio, or fixed asset turnover, tells you how many dollars of sales your company receives for each dollar invested in property, plant, and equipment (PPE). How to calculate PPE turnover depends on all three of these assets. In other words, this formula is used to understand how well the company is utilizing their equipment to generate sales.įor investors and stakeholders this is extremely crucial because they want to ensure there’s an approximate measure for return on their investment. Credit lenders also look at PPE turnover ratio to make sure the company can produce enough revenue from a new piece of equipment and then in return pay back the loan they used to purchase it.

0 kommentar(er)

0 kommentar(er)